Contents:

Forex trading is short for foreign exchange, often called ‘FX’ and focuses on the exchange of one currency for another. When you are ready to open a live trading account, you may be curious how much money you need to do so. Or, perhaps you’re interested in starting trading Forex with a small amount of money. You can open a live or demo trading account in just a few minutes to see all the products and services available to you.

- You can learn more about these principles in detail in our article,How to Become a Successful Forex Trader.

- When you are trading with borrowed money, your forex broker has a say in how much risk you take.

- This agreement states that you will be trading with borrowed money and, as such, the brokerage has the right to intervene in your trades to protect its interests.

- They’ll provide lots of information to help get you started.

- However, if someone day trades, they may also make long term investments as well (a long-term portfolio).

With Admirals, you can open a Trade.MT5 or a Zero.MT5 account with a minimum deposit of $100 . Beyond webinars, we also offer an extensive library of educationalarticlesfor traders to learn each detail, strategy, and fact about the market and industry. Positional trading- This entails following long-term trends and aiming to maximise profits from large price shifts. The other three strategies in this list are short-term strategies, while positional trading is a long-term approach. When it comes to deciding which Forex trading strategy is the best and most profitable, there is really no single answer. Determining which are the best FX strategies depends on the individual.

How to Start

Forex, which is a portmanteau of “foreign exchange”, is one of the most significant and widespread financial activities on the planet. Put simply, it is the act of exchanging one currency for another on the global marketplace at existing exchange rates, whether for business transactions, tourism, or profit. The values of different currencies relative to one another (i.e. the value of the US dollar to the euro), change throughout the day, week, month, and year. Anyone who wants to be a forex trader should find a successful trader or two to watch for ideas.

8 Steps to Building a Strong Trading Plan – ForexLive

8 Steps to Building a Strong Trading Plan.

Posted: Fri, 28 Apr 2023 09:55:00 GMT [source]

Look for the number of countries under which the firm is https://1investing.in/. Not forgetting to get legit brokers, by researching about them as some a scams, helps.” Usually, the broker will send you an email containing a link to activate your account. Click the link and follow the instructions to get started with trading.

How to Start Trading Forex Online Using Trading Strategies

Still, to a retail investor, even the statistics regarding minor pair currency trading volumes will seem quite impressive. Your broker will list all available platforms on its website, and you’re free to download whichever you want. However, I strongly recommend starting with a third-party trading platform such as MetaTrader. This is arguably the most popular trading platform among retail Forex traders, with tons of features and charting tools to assist you in your market research. MetaTrader also has a large online community and hundreds of available add-ons to download for free. Customer support – Last but not least, you need to be sure that the broker provides some kind of customer support.

A guide to CFD trading strategies – FOREX.com

A guide to CFD trading strategies.

Posted: Wed, 26 Apr 2023 12:46:57 GMT [source]

You should take the necessary time to research and find the best broker for you. In this Forex trading guide, you won’t need to search in Google “how to start Forex trading Reddit,” where the reliability of the results you receive would be questionable. History of Forex Trading Forex trading is a legalized global business of exchanging different world currencies and other… Economic calendar, are the types of tools you should look out for. The same way you wouldn’t buy a car if all the feedback was that the brakes don’t work.

Forecast the “weather conditions” of the market

If you want to become a profitable trader you need to master your mentality and risk management. These are arguably the most important things on your journey to becoming a successful trader. If you want to actually learn how to trade Forex, you’ll need a basic understanding on how Forex trading works to begin with. After this unit you will know exactly how the market works.

Check out our free trading guides to learn more about this popular approach to forex trading. Forex is also known as the foreign exchange marketplace and refers to the exchange of different currencies from countries all over the world. The world offorex tradingmoves quickly and is full of thrills and the potential for huge financial success. Taking the time to educate yourself and learn about forex trading before you get started will help you make the most of your time spent trading.

Now I understand what Forex is and I feel ready to jump to a demo account.” If you want to learn common pitfalls which will cause you to make bad trades, consult a trusted money manager. Your gains and losses will either add to the account or deduct from its value. For this reason, a good general rule is to invest only two percent of your cash in a particular currency pair. A short position means that you want to buy quote currency and sell the base currency.

How to Become a Successful Forex Trader

It is one of the world’s most actively traded markets, with an average daily trading volume of $6.6 trillion, according to the Bank of International Settlements. Famous forex traders include George Soros and Paul Tudor Jones. If you’re asking yourself how to start forex trading in 7 steps, this article points the way. For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than in other markets. For those with longer-term horizons and more funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals that drive currency values, as well as experience with technical analysis, may help new forex traders become more profitable.

Like with any other kind of investing, currency trading requires you to show some level of restraint. The simplest way to do so is to limit yourself from the very start. You see, you need to set a minimum capital that you will use for currency trading and only stick to these funds.

Try a Demo Account

A currency or forex trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. The only major difference is that for forex accounts, you are required to sign a margin agreement. This agreement states that you will be trading with borrowed money and, as such, the brokerage has the right to intervene in your trades to protect its interests. That said, once you sign up and fund your account, you’ll be ready to trade. Sniping and hunting are the premature buying or selling of currency near preset points. They are inappropriate activities used to increase profits.

Some focus on one particular study or calculation, while others use broad spectrum the difference between an executive director a to determine their trades. Reading the reports and examining the commentary can help forex fundamental analysts gain a better understanding of long-term market trends. Short-term traders may learn to profit from extraordinary events. It requires you to trade with a minimum of, say, $250 and offers a high amount of leverage .

Getting Started in Forex

This is because you are buying one currency while simultaneously selling the other currency as part of the currency pair contract, hence no actual physical delivery is required. On the other hand, apurely discretionary trading approachinvolves taking trades based on where your own analysis of fundamentals, price action, or risk sentiment. Want to master technical analysis and learn how to use indicators to accurately predict the market? Learn the main differences between forex and stocks to understand the best market to trade based on your trading style and strategy.

Make sure that your risk capital is large enough to withstand such price shocks. 5) Use pending orders when you’re not in front of your computer – Pending orders are a great and time-efficient way to trade the market. Whenever you see a potential trade setup which has not yet been confirmed, you can place a pending order to trade the upcoming price movement.

What may be ideal for one trader may be a disaster for another. Once you’re up and running, and in a position to make steady returns, you might start to consider how much money you need to start Forex trading as a full-time business. You can learn more about these principles in detail in our article,How to Become a Successful Forex Trader.

This unit will teach you the advanced trading strategies used by professionals. Learn the basics, through to advanced trading strategies. Alternatively, you could use algorithms and cutting edge trading tools to do some of the analysis for you.

You can ask for the paperwork by mail or download it, usually in the form of a PDF file. Make sure to check the costs of transferring cash from your bank account into your brokerage account. You can open a personal account or you can choose a managed account. With a personal account, you can execute your own trades.

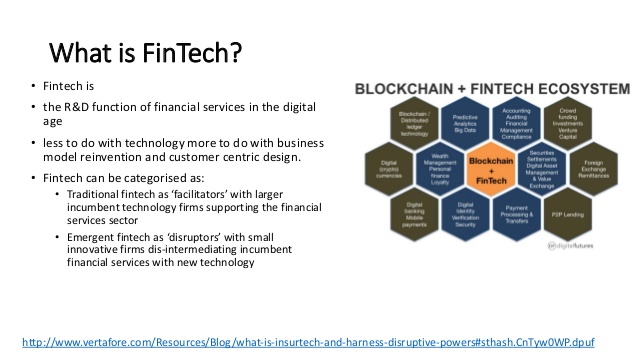

The value of different currencies moves in different directions and at different paces. Today, due to the hyperconnectivity of the world through the internet, these changes are quite rapid, and they can be followed in real-time. Many platforms like Forex.com, for example, offer both forex and CFD trading. Bear in mind that being familiar with the basic economic principle which allows people to make money on the forex market doesn’t mean you can reliably predict future market movements.

When planning ahead for forex trading, deciding the exact level of financial risk you want to take while trading should be one of the first decisions that you make. If you don’t decide until you are already trading, you are likely to be both mentally and financially in over your head before you even know it! The last thing you want is for your time in forex trading to be over before it has really begun. For example, the price of a Facebook share could easily rise or fall by 5% in a trading session, whereas a 1% change in a currency pair during a trading session is unusual. Forex is a 24/5 market and experiences moderate changes during the various sessions, unlike share prices that can suddenly and sharply rise or fall when markets open.